If you are planning to study in India or abroad and worried about money, a DBS study loan (DBS education loan) can be a helpful option. DBS Bank, also known as Development Bank of Singapore, offers education loans to Indian students for higher studies. The process is mostly online, the interest rates are student-friendly, and you also get tax benefits on the interest you pay.

In this blog, we will explain in very simple language:

- What is a DBS study loan?

- Main features and benefits

- Eligibility criteria

- Documents required

- How EMI is calculated (with example)

- Tax benefits on DBS education loan

- Tips to increase your chances of loan approval

What Is a DBS Study Loan?

A DBS study loan is a type of education loan given by DBS Bank to students who want to study in India or abroad. The money from this loan can be used to pay:

- College or university tuition fees

- Hostel or accommodation charges

- Books and study material

- Exam, library, and lab fees

- Travel expenses (for overseas education, if allowed by the scheme)

You don’t need to pay the full fees from your savings. Instead, the bank pays the money to the college (or to you), and you return it later in easy EMIs (Equated Monthly Instalments).

Features and Benefits of DBS Education Loan

According to DBS and partner platforms like BankBazaar and WeMakeScholars, the DBS education loan has many useful features.

1. Easy Online Process

- You can apply for the DBS study loan online through digital platforms like Digibank by DBS, BankBazaar, or WeMakeScholars.

- You don’t always need to visit the bank branch many times.

- Upload documents, fill the form, and track the status online.

2. Student-Friendly Interest Rates

- DBS offers competitive interest rates compared to many other education loans.

- Interest rates may be floating, which means they can change with market conditions.

A lower interest rate means a lower EMI and total interest over the years.

3. Flexible Repayment Options

- You usually get a moratorium period: during the course + some extra months (often 6–12 months after getting a job).

- Full EMI starts after this period, so you can focus on your studies first.

4. Tax Benefits under Section 80E

- The interest you pay on the DBS education loan can be claimed as a tax deduction under Section 80E of the Income Tax Act.

- There is no upper limit on the amount of interest you can claim, but the benefit is usually available for up to 8 years or until interest is fully repaid (whichever is earlier).

5. Can Cover Multiple Costs

Depending on the scheme and approval:

- Tuition fees

- Exam fees

- Library and lab fees

- Travel and visa costs (for foreign education)

- Living expenses as per bank rules

Eligibility Criteria for DBS Study Loan

BankBazaar clearly mentions the main eligibility conditions for DBS Bank education loan.

You are generally eligible if:

- Nationality & Age

- You are an Indian national.

- Your age is between 18 and 35 years at the time of application.

- You are an Indian national.

- Course Type

- You are going for a graduate, post-graduate or PG diploma course.

- The course can be in India or abroad (as per bank’s policy).

- You are going for a graduate, post-graduate or PG diploma course.

- Institute Recognition

- You must have secured admission in a recognised institute/university.

- It should be approved by relevant bodies (UGC, AICTE, etc. for India, or recognised foreign universities).

- You must have secured admission in a recognised institute/university.

- Co-Applicant (Co-borrower) Is Required

- A co-applicant is mandatory for full-time courses.

- Co-applicant can be:

- Parent

- Guardian

- Spouse (in some cases)

- Parent

- The co-applicant should have a stable income and a good credit history.

- A co-applicant is mandatory for full-time courses.

- Collateral / Guarantor (For Higher Amounts)

- For higher loan amounts, the bank may ask for collateral (like property, FD, etc.) or a guarantor.

Documents Required for DBS Study Loan

As per BankBazaar, you will need to submit the following documents with your loan application.

1. Identity Proof (Any One)

- PAN Card

- Aadhaar Card

- Passport

- Driving Licence

- Voter ID

2. Address Proof (Any One)

- Aadhaar Card

- Passport

- Driving Licence

- Voter ID

3. Income Proof of Co-Applicant

- Last 2 years Income Tax Returns (ITR)

- Last 3 months’ salary slips (for salaried)

- For self-employed:

- Financial statements for last 2 years

- Office address proof (CA certified)

- Financial statements for last 2 years

4. Education Documents

- Class 12 marksheet and certificate

- Graduation marksheet (if applicable)

- Entrance exam scorecards – CAT, GRE, GMAT, TOEFL, IELTS, etc., if applicable

- Admission letter from the college/university

Make sure all documents are clear, updated, and correctly scanned if you are applying online.

How Does DBS Education Loan EMI Work?

The EMI (Equated Monthly Instalment) is the fixed amount you pay every month after your moratorium period ends.

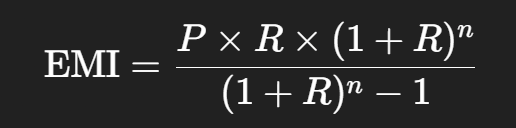

BankBazaar shows the standard EMI formula used for DBS education loan:

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate / 12 / 100)

- n = Number of monthly instalments

Example EMI Calculation for DBS Study Loan

Example:

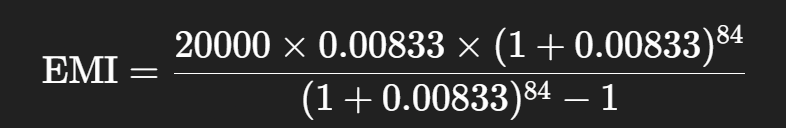

You take a DBS study loan of $20,000 for overseas education.

Interest rate = 10% per annum (example only, actual rate may differ).

Tenure = 7 years = 84 months.

- Convert annual rate to monthly rate:

- Annual rate = 10%

- Monthly rate, R = 10 / (12 × 100) = 0.10 / 12 ≈ 0.00833

- Annual rate = 10%

- Values:

- P = 20,000

- R ≈ 0.00833

- n = 84

- P = 20,000

- Put values in the formula:

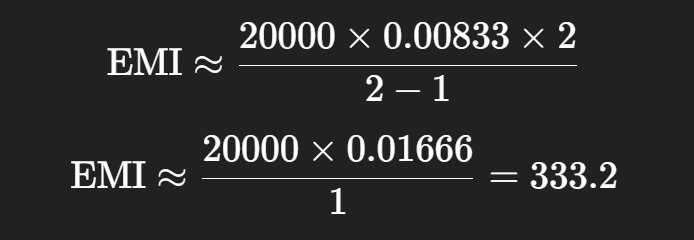

If we calculate step by step:

- (1 + 0.00833) ≈ 1.00833

- (1.00833)⁸⁴ ≈ 2.0 (approx for understanding)

So,

So, approximate EMI ≈ $333 per month.

Note: This is a rough example to help you understand. Actual EMI depends on exact interest rate, processing fee, and bank’s policies. You should always use a DBS education loan EMI calculator online for accurate values.

Simple Cost of Borrowing Example

Using the same approximate EMI:

- EMI ≈ $333

- Tenure = 84 months

Total amount paid ≈ 333 × 84 = $27,972

- Principal = $20,000

- Total interest ≈ 27,972 – 20,000 = $7,972

So in this example, you pay around $7,972 as interest over 7 years.

This shows why interest rate and tenure are important. Lower rate or shorter tenure can save a lot of money.

Tax Benefit Example under Section 80E

Now, let’s see a simple example of tax saving on a DBS study loan.

Assume:

- You pay $3,000 per year as interest on your DBS education loan.

- Your income falls in a 20% tax slab (example for understanding).

Under Section 80E, you can claim $3,000 as deduction from your taxable income.

So tax saving ≈ 20% of 3,000 = $600.

This means, because of your education loan interest, your tax payable reduces by $600 for that year.

Important: Section 80E benefit is only on interest, not on principal. Also, tax laws and slabs in India apply in INR, not USD. Here we used dollars only as a simple example for calculation. Consult a tax expert for real numbers.

How to Apply for a DBS Study Loan

You can apply through:

- DBS Digibank app / website

- Loan marketplaces like BankBazaar

- Education loan platforms like WeMakeScholars

Step-by-Step Process (General)

- Check Eligibility

- Age, course, institute, nationality, co-applicant income, etc.

- Age, course, institute, nationality, co-applicant income, etc.

- Collect Documents

- ID proof, address proof, income proof, academic documents, admission letter, etc.

- ID proof, address proof, income proof, academic documents, admission letter, etc.

- Fill Online Application Form

- Enter personal details, course details, loan amount required, co-applicant details.

- Enter personal details, course details, loan amount required, co-applicant details.

- Upload Documents

- Scan and upload required documents as per guidelines.

- Scan and upload required documents as per guidelines.

- Verification by DBS

- Bank checks your documents, credit score, co-applicant income, and course details.

- Bank checks your documents, credit score, co-applicant income, and course details.

- Loan Sanction & Offer Letter

- If approved, you receive a sanction letter with loan amount, interest rate, tenure, and other terms.

- If approved, you receive a sanction letter with loan amount, interest rate, tenure, and other terms.

- Disbursement

- After completing formalities, the loan amount is disbursed either directly to the college/university or to your account, as per rules.

Tips to Improve Your Chances of Getting a DBS Study Loan

- Maintain a Good Credit Score (Co-applicant)

- Make sure your parent/guardian has a good repayment history on existing loans and credit cards.

- Make sure your parent/guardian has a good repayment history on existing loans and credit cards.

- Choose a Recognised Institute

- Banks feel safer lending for reputed institutes and courses with good placement records.

- Banks feel safer lending for reputed institutes and courses with good placement records.

- Apply Early

- Don’t wait till the last minute. Start the loan process as soon as you receive your admission letter.

- Don’t wait till the last minute. Start the loan process as soon as you receive your admission letter.

- Keep All Documents Ready and Clear

- Mismatched or missing documents can delay or even reject your application.

- Mismatched or missing documents can delay or even reject your application.

- Borrow Only What You Need

- A lower loan amount is easier to get approved and also reduces your future EMIs and interest.

Is a DBS Study Loan Right for You?

A DBS study loan can be a good choice if:

- You want a digital-first bank with easy online application.

- You need flexible repayment after your course.

- You are looking for competitive interest rates and tax benefits on education loan interest.

However, before deciding, you should:

- Compare DBS study loan with other bank education loans.

- Check interest rates, processing fees, moratorium period, and penalties.

- Read the sanction letter carefully and ask questions if you don’t understand any terms.

Final Thoughts

Higher education, especially abroad, can be expensive. A DBS study loan / DBS education loan helps you manage these costs by spreading them over several years in the form of EMIs. With simple online process, student-friendly interest rates, tax benefits, and flexible repayment options, it can be a useful tool for both students and parents.

Always remember:

- Understand the total cost of borrowing (EMI × number of months).

- Use an EMI calculator before taking the loan.

- Never borrow more than you can comfortably repay after getting a job.

If you use a DBS study loan wisely, it can become an investment in your future career, not just a burden.