Education is one of the most important investments in life. However, higher studies in India or abroad can be expensive. That’s where the Bank of Baroda (BOB) Education Loan comes in.

This loan helps students fulfill their academic dreams without financial stress. Whether you plan to study in India or overseas, BOB offers flexible, affordable, and reliable education loans.

In this blog, we’ll explain everything about the BOB Education Loan, including its features, eligibility, interest rates, repayment options, margin money, EMI calculations, and application process — all in easy language.

🎓 What is a BOB Education Loan?

A BOB Education Loan is a financial assistance scheme designed for students who wish to pursue higher education in India or abroad.

It covers tuition fees, books, accommodation, travel, and other educational expenses.

Bank of Baroda offers multiple education loan schemes, such as:

| Scheme Name | Suitable For |

| Baroda Gyan | Students studying in India |

| Baroda Scholar | Students studying abroad |

| Baroda Education Loan for Premier Institutions | Students admitted to top Indian institutions |

| Skill Loan Scheme | Students pursuing vocational or skill development courses |

Each scheme has its own eligibility, amount, and interest rate, which we’ll explain below.

🌏 Key Features of BOB Education Loan

| Feature | Details |

| Loan Amount | Up to ₹150 lakh (for studies abroad under Baroda Scholar) |

| Interest Rate | Around 9.25% – 11.50% (varies by course/institution) |

| Repayment Period | Up to 15 years after the moratorium |

| Moratorium Period | Course period + 1 year or 6 months after getting a job |

| Processing Fee | Nil for most Indian institutions |

| Security/Collateral | Depends on loan amount and type |

| Prepayment Charges | Nil |

| Top-up Loan Option | Available for higher studies after graduation |

🎯 Eligibility Criteria

To get a BOB education loan, students must meet certain eligibility conditions:

- Nationality: Indian citizen.

- Admission: Must have secured admission to a recognized institution in India or abroad.

- Courses Covered:

- Graduate, Postgraduate, or Doctorate programs.

- Professional or technical courses like Engineering, Medicine, Management, Law, etc.

- Skill development or diploma courses (under the Skill Loan Scheme).

- Graduate, Postgraduate, or Doctorate programs.

- Co-borrower: Usually, a parent or guardian acts as a co-applicant.

💰 Expenses Covered by the Loan

BOB education loans cover almost all academic expenses, such as:

- Tuition and examination fees

- Library and laboratory charges

- Hostel and mess fees

- Books, equipment, and uniforms

- Travel expenses (for studies abroad)

- Caution deposit, building fund, or refundable fees (within limits)

- Laptop or computer (if essential for the course)

This means you don’t have to worry about any major educational expense.

📊 Loan Amount Limits

| Type of Study | Maximum Loan Amount |

| Studies in India | Up to ₹80 lakh |

| Studies Abroad | Up to ₹150 lakh |

| Skill Development Courses | ₹1.5 lakh to ₹2.5 lakh (based on duration) |

These limits depend on the course, institution, and the borrower’s repayment capacity.

📈 Interest Rates (as per latest BOB data)

BOB uses RLLR (Repo Linked Lending Rate) to calculate interest.

As of now (example rate: RLLR = 9.25% p.a.):

| Type of Student | Interest Rate (approx.) |

| Premier Institutions | RLLR + 0.00% to 0.50% |

| Studies in India | RLLR + 1.25% |

| Studies Abroad | RLLR + 1.75% |

| Female Students | 0.50% concession |

| Skill Loan Scheme | Around 9.75% |

👉 Note: These rates may change depending on RBI updates and Bank policies.

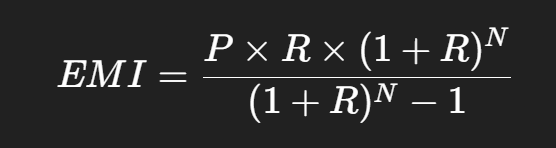

🧮 EMI Calculation Example

Let’s understand with a simple example:

Example:

A student takes a ₹10 lakh loan for 7 years at an interest rate of 9.25%.

Using a basic EMI formula:

Where:

- P = ₹10,00,000

- R = 9.25% ÷ 12 = 0.007708

- N = 7 × 12 = 84 months

✅ EMI = ₹16,145 approx.

So, the student will repay around ₹13.5 lakh in total over 7 years.

This helps you plan your budget before applying.

⏳ Repayment Terms

- Repayment starts after the moratorium period (course duration + 1 year).

- Repayment tenure is up to 15 years after the moratorium.

- You can make part-payments or prepay the loan anytime without extra charges.

💡 Example:

If you study a 4-year engineering course and get a job within 6 months, your EMI will start after that 6-month period.

🔒 Security and Collateral

Collateral depends on the loan amount:

| Loan Amount | Security Required |

| Up to ₹4 lakh | No security (Parent/Guardian as co-borrower) |

| ₹4 lakh – ₹7.5 lakh | Third-party guarantee |

| Above ₹7.5 lakh | Tangible collateral (property, FD, LIC policy, etc.) |

Bank of Baroda also offers 100% collateral-free loans under CGFSEL (Credit Guarantee Fund Scheme for Education Loans) up to ₹7.5 lakh.

📄 Documents Required

You’ll need to submit both student and co-applicant documents.

1. Student Documents

- Admission letter from the institution

- Mark sheets (10th, 12th, graduation)

- Fee structure from the college/university

- Passport and Visa (for overseas studies)

- Proof of income (if employed)

2. Co-applicant Documents

- Identity proof (PAN, Aadhaar)

- Address proof

- Income proof (ITR, salary slips, bank statements)

- Collateral documents (if applicable)

📘 You can also download the BOB Education Loan Checklist PDF directly from the Bank of Baroda official website.

🧭 How to Apply for a BOB Education Loan

You can apply online or offline easily.

Online Application

- Visit the official Bank of Baroda Education Loan Portal.

- Select the “Apply Now” option under Education Loan.

- Fill in your details and upload documents.

- The bank will verify and contact you for next steps.

Offline Application

- Visit your nearest Bank of Baroda branch.

- Ask for the Education Loan Application Form.

- Fill in the details and attach all required documents.

- Submit to the loan officer and complete the verification process.

Once approved, the loan amount is disbursed directly to your educational institution.

🏫 Benefits of BOB Education Loan

- ✅ Affordable interest rates

- ✅ No prepayment penalty

- ✅ Flexible repayment up to 15 years

- ✅ Collateral-free loans up to ₹7.5 lakh

- ✅ Quick processing and approval

- ✅ Interest subsidy for economically weaker students under government schemes

💡 Government Subsidy Schemes via BOB

BOB also implements several government education loan subsidy programs such as:

| Scheme | Benefit |

| Padho Pardesh Scheme | Interest subsidy for minority students studying abroad |

| CSIS (Central Sector Interest Subsidy) | Interest subsidy during the moratorium period for economically weaker students studying in India |

| Dr. Ambedkar Central Sector Scheme | For OBC and EWS category students pursuing higher education abroad |

These schemes help reduce the financial burden during the study period.

📊 Example of Total Cost Comparison

| Particular | Study in India | Study Abroad |

| Loan Amount | ₹10 lakh | ₹20 lakh |

| Tenure | 10 years | 15 years |

| Interest Rate | 9.25% | 10.25% |

| EMI (approx.) | ₹12,730 | ₹21,860 |

| Total Payment | ₹15.3 lakh | ₹39.4 lakh |

This comparison helps students and parents estimate the repayment amount in advance.

🌐 Tips Before Applying

- Compare education loan options of BOB with other banks.

- Always check the latest interest rates on the official website.

- Keep all documents ready before applying to avoid delay.

- Use BOB’s Education Loan EMI Calculator to plan repayment.

- Consider the moratorium period when planning your career and finances.

🧠 Example Case Study

Case:

Riya, an engineering student, got admission to a top Indian college.

She applied for a BOB Baroda Gyan Loan of ₹6 lakh at 9.25% interest for 8 years.

Her moratorium is 4 years (course) + 1 year grace.

After graduation, her EMI started at ₹8,785 per month.

She repaid the loan in full before 8 years without any penalty.

✅ Result: Riya completed her education smoothly and built a good credit history.

🏁 Conclusion

The BOB Education Loan is an excellent choice for students who wish to pursue higher education in India or abroad without financial stress.

It offers affordable interest rates, flexible repayment options, and government subsidy benefits.

Whether you are a student, parent, or guardian — understanding the details of the Baroda Gyan or Baroda Scholar loan can help you make informed financial decisions.

With proper planning and timely repayment, education loans not only support your academic dreams but also build your financial discipline and credit score.