Studying abroad is a dream for many Indian students. However, the high cost of international education often becomes a major challenge. Tuition fees, accommodation, travel, and living expenses can easily add up to ₹40–₹80 lakhs or even more.

That’s where Credila Education Loan, now a part of Kotak Mahindra Bank, helps students achieve their global education goals without financial stress. Credila provides customized education loans for students pursuing higher studies in India or abroad, offering flexible repayment options and digital processing.

In this blog, we’ll explain everything about Credila Education Loans — from interest rates and eligibility to example EMI calculations and benefits.

📘 What Is a Credila Education Loan?

Credila, founded in 2006, is India’s first dedicated education loan company. It is now a subsidiary of Kotak Mahindra Bank, focusing exclusively on education financing.

Credila offers loans for undergraduate, postgraduate, and professional courses across 4,600+ universities in 63 countries.

You can apply for loans to study in countries like:

- USA

- UK

- Canada

- Australia

- Germany

- Singapore

- France, and more

💰 Key Features of Credila Education Loan

| Feature | Details |

| Loan Amount | Up to ₹75 lakh (unsecured) and ₹1.5 crore (secured) |

| Interest Rate | 8.95% to 13.0% (variable) |

| Processing Fee | 0.5% to 1% + GST |

| Margin Money | Nil |

| Moratorium Period | Course duration + 12 months |

| Repayment Tenure | Up to 12 years |

| Prepayment Charges | None |

| Tax Benefit | Under Section 80E of the Income Tax Act |

| Coverage | Tuition, living expenses, travel, exam fees, and insurance |

These features make Credila one of the most flexible education loan providers in India.

🎓 Eligibility Criteria

Before applying, check if you meet the eligibility requirements.

| Criteria | Details |

| Applicant | Indian citizen, at least 16 years old |

| Admission | Must have admission to a recognized university (India or abroad) |

| Co-applicant | Parent/guardian with a steady income |

| Credit Score | Good credit history preferred |

| Collateral | Optional (for loans up to ₹75 lakh, unsecured available) |

📂 Documents Required

You’ll need to submit both student and co-applicant documents:

Student Documents

- KYC (Aadhaar, PAN, Passport)

- Admission letter or I-20 (for the USA)

- Fee structure from the university

- Academic records (10th, 12th, graduation mark sheets)

- Entrance test scores (GRE, GMAT, IELTS, TOEFL)

Co-applicant Documents

- ID and address proof

- Income proof (salary slips, ITR, Form 16, or bank statements)

- Collateral documents (if applicable)

📊 Interest Rate & EMI Calculation (with Example)

Credila’s interest rate varies between 8.95% and 13%, depending on factors like:

- University ranking

- Student’s academic background

- Country of study

- Collateral availability

- Co-applicant’s income

Let’s understand this with a real-life example 👇

Example 1: Loan with Collateral

Suppose you borrow ₹40,00,000 for a 2-year master’s program abroad.

- Interest rate: 9.5% p.a.

- Tenure: 10 years (after moratorium)

- Moratorium: 2 years course + 1-year grace = 3 years total

During moratorium: Interest continues to accrue.

Let’s calculate simple interest for 3 years.

Interest = Principal × Rate × Time / 100

= 40,00,000 × 9.5 × 3 / 100

= ₹11,40,000

So, at the end of 3 years, your total amount = ₹51,40,000.

Now, EMI (for ₹51,40,000 over 10 years at 9.5%) ≈ ₹66,000/month.

Example 2: Unsecured Loan

If you borrow ₹20,00,000 at 12% interest for 8 years:

EMI = ₹35,300/month (approx.)

This shows how the interest rate and tenure directly affect repayment.

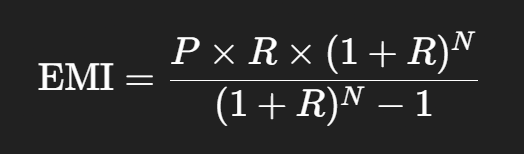

🧮 How to Calculate EMI

You can easily estimate your EMI using this formula:

Where:

- P = Loan Amount

- R = Monthly Interest Rate (Annual rate / 12)

- N = Number of Months

Or you can use Credila’s online EMI calculator for quick results.

📱 Step-by-Step Process to Apply

Credila offers a fully digital 5-step process:

- Check Eligibility Online

Visit GyanDhan or Kotak Mahindra Bank’s Credila page and fill in your course details. - Talk to a Loan Expert

You’ll get personalized advice on loan type, interest rate, and document checklist. - Upload Documents Digitally

Scan and upload required papers — no need for physical visits. - Get Conditional Approval

Credila evaluates your profile and provides a loan sanction letter. - Disbursement

The amount is disbursed directly to your university or as per the payment schedule.

🏡 Collateral Options

Credila accepts both movable and immovable collateral:

| Type | Examples |

| Movable | Fixed Deposits, Life Insurance Policies |

| Immovable | House, flat, non-agricultural land |

Loans up to ₹75 lakh can be unsecured, which means no collateral required — a great advantage for students from middle-income families.

🧾 Expenses Covered

Credila provides 100% financing, covering more than just tuition fees:

✅ Tuition and exam fees

✅ Accommodation or hostel charges

✅ Living expenses (food, transport, stationery)

✅ Laptop and books

✅ Travel expenses (airfare)

✅ Health or student insurance

Example:

If your total estimated cost to study in the USA is ₹45 lakh (₹30 lakh tuition + ₹15 lakh living expenses), Credila can cover the full amount under a secured loan.

🕒 Repayment Period and Moratorium

Credila offers one of the longest repayment periods — up to 12 years.

- Moratorium period = Course duration + 12 months

- During this time, students usually pay simple interest (SI) or partial interest.

- After this, full EMI starts automatically.

Example:

If your course lasts 2 years, you get 3 years before EMI repayment starts (2 years course + 1-year grace).

💡 Benefits of Credila Education Loan

Here are the top reasons why students choose Credila:

- Customized loan plans for different countries and universities.

- No margin money — 100% cost covered.

- No prepayment penalty — you can repay early without extra charges.

- Digital processing — apply and track online.

- Flexible co-applicant policies — parents, siblings, or guardians allowed.

- Top-up loan option — for additional expenses later.

- Tax benefit under Section 80E — interest paid is tax-deductible.

⚖️ Secured vs Unsecured Loan Comparison

| Parameter | Secured Loan | Unsecured Loan |

| Collateral | Required | Not required |

| Interest Rate | Lower (8.95%–10%) | Higher (11%–13%) |

| Loan Amount | Up to ₹1.5 crore | Up to ₹75 lakh |

| Approval Time | 7–10 days | 3–5 days |

| Eligibility | Flexible | Strict (income & credit score) |

🧠 Tips to Get Lower Interest Rate

- Add collateral – lowers the risk for Credila.

- Choose reputed universities – better career prospects = lower rate.

- Maintain good academic scores – reflects reliability.

- Co-applicant with stable income – increases approval chances.

- Compare through GyanDhan – you can negotiate better rates.

🪙 Example of Tax Benefit under Section 80E

Let’s assume:

- You pay ₹1,00,000 interest per year.

- Your income falls under 30% tax bracket.

Then you save:

₹1,00,000 × 30% = ₹30,000 tax saved per year.

This benefit is available for 8 years from the start of repayment, helping reduce your financial burden.

📢 Credila Loan Success Stories (Examples)

1. Priya from Mumbai – MS in USA

Priya got admission to Northeastern University. Her total cost was ₹48 lakh. Credila approved a secured loan of ₹45 lakh at 9.25% interest.

She paid only simple interest during her 2-year course, then started EMI of ₹59,000/month.

2. Aman from Delhi – MBA in UK

Aman got an unsecured loan of ₹20 lakh at 11.5% interest for a 1-year MBA.

He repaid the full loan in 5 years and saved ₹20,000 through early prepayment since Credila has no prepayment penalty.

🌟 Conclusion

A Credila Education Loan is an excellent choice for students who dream of studying abroad but lack immediate funds. With up to 100% financing, flexible repayment, and customized options, it removes financial barriers to higher education.

Whether you’re applying for an MS in the USA, MBA in the UK, or a degree in Australia, Credila provides fast, transparent, and student-friendly loans.

So, if you’re planning your global education journey, take the next step confidently — apply for a Credila Education Loan today and turn your study-abroad dream into reality.