When you apply for an education loan from Bank of Baroda (BoB) for studies in India or abroad, one of the key terms you’ll come across is “margin money.” In this blog, we’ll explain what margin money means, how much BoB typically requires, what factors determine it, and we’ll show you examples and calculations to help you plan better. Let’s check what is the margin money on a BOB education loan?

What is “Margin Money”?

“Margin money” in the context of education loans is the portion of the total education cost that the student (or their parents/co-applicant) must arrange themselves (i.e., pay upfront or contribute) rather than being financed fully by the bank.

In simpler terms:

- Suppose your total cost to study (tuition + living expenses + travel + other fees) is ₹10 lakh.

- If the bank gives you a loan for ₹9 lakh, then the “margin money” you contributed is ₹1 lakh (10%).

- The margin ensures that you have some “skin in the game” and reduces the bank’s risk.

In the case of Bank of Baroda, margin money requirements vary depending on the loan scheme, the amount, the institution (whether it’s a premier institution or not), and whether the study is in India or abroad.

Requirements – Key Details on What Is the Margin Money on a BOB Education Loan?

Here are the typical margin money rules for BoB, based on published sources:

- For some domestic education-loan schemes (for certain “Premier Institutions”), BoB states that no margin money is required for loans up to ₹4 lakh.

- For amounts above ₹4 lakh, margin money of 5% is cited in certain domestic scheme.

- For study‐abroad loans or higher-loan amounts, margin money can range up to 10% to 15% depending on institution and collateral status.

- Some sources mention 0-15% margin, or 0% for top-listed institutions.

Summary Table

| Scenario | Margin Money Requirement |

| Domestic loan to a “Premier Institution”, and loan amount up to ~₹4 lakh | 0% |

| Domestic loan above ₹4 lakh (for certain schemes) | ≈ 5% |

| Study abroad / large loan amounts / non-premier institution | ≈ 10–15% |

Important: These are indicative. The exact margin will depend on the specific scheme (e.g., “Baroda Gyan”, “Baroda Scholar”, “Baroda Education Loan for Premier Institutions”), the institution you are attending, the country (if abroad), whether collateral is required, etc. Always check the latest official Bank of Baroda brochure or ask the branch.

Why Does Margin Money Vary?

- Type of Institution: If your university/college is on the bank’s approved “Premier Institutions” list, banks are more comfortable with financing a higher percentage (sometimes 100%) and hence may ask for 0% margin.

- Loan Amount / Study Abroad: For large amounts or overseas education (higher cost, higher risk for bank), banks ask for higher margin money (10%-15%).

- Collateral & Security: If collateral/security is weak, margin might be higher. If full collateral is provided, margin may be lower.

- Type of Course / Country: Some courses, countries, or universities may be deemed higher risk.

- Bank Scheme Conditions: Each scheme (Baroda Gyan, Baroda Scholar etc) has its own terms.

Example Calculations

Let’s look at a few examples to see how margin money works in practice.

Example 1: Domestic loan, small amount

- Total cost of study (tuition + other expenses): ₹3.5 lakh

- You apply for a loan from Bank of Baroda under the domestic “Premier Institutions” scheme which allows 0% margin up to ₹4 lakh.

- Margin money required = 0% of ₹3.5 lakh = ₹0

- Loan amount you may get = ₹3.5 lakh

Example 2: Domestic loan, above ₹4 lakh

- Total cost: ₹6 lakh

- Under the domestic scheme the margin above ₹4 lakh is ≈5%.

- Margin money = 5% of ₹6 lakh = ₹0.30 lakh (₹30,000)

- Loan amount you may get = ₹6 lakh – ₹0.30 lakh = ₹5.70 lakh

Example 3: Study abroad, higher amount

- Total cost of study abroad: ₹25 lakh

- Suppose it is a non-premier institution or higher risk scenario where margin is 10%.

- Margin money = 10% of ₹25 lakh = ₹2.5 lakh

- Loan amount you may get = ₹25 lakh – ₹2.5 lakh = ₹22.5 lakh

Example 4: Study abroad, very large amount, margin 15%

- Total cost: ₹80 lakh

- Margin: 15%

- Margin money = 15% of ₹80 lakh = ₹12 lakh

- Loan amount = ₹80 lakh – ₹12 lakh = ₹68 lakh

These examples show how margin money affects the portion of cost you personally must cover, and how it reduces the loan amount.

How to Calculate Your Own Margin Money Quickly

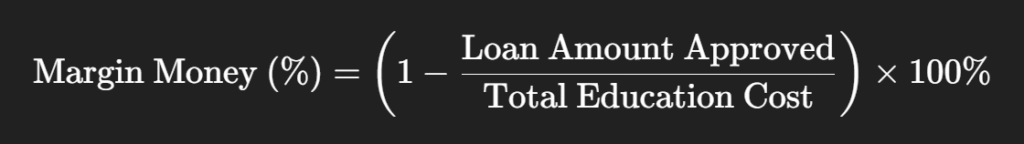

Here’s a formula you can use:

And also:

Margin Money (₹)=Total Education Cost−Loan Amount Approved

So if you know your total cost (say, ₹X) and the percentage margin (say, Y %), then:

- Margin money amount = Y% × X

- Loan amount = X – (Y % × X)

Tip: When you are deciding on your budget, factor in that margin money must be arranged. Do not assume 100% of the cost will be financed.

Practical Tips for Students & Parents

- Check the specific scheme: Bank of Baroda offers multiple schemes (for domestic studies, abroad studies, digital loans etc). Always check “Baroda Scholar”, “Baroda Gyan”, “Baroda Education Loan to Premier Institutions” etc.

- Check the institution list: If your college/university is considered “Premier” by the bank, you may qualify for 0% or lower margin.

- Budget for margin: Don’t assume 0%. For many scenarios you’ll need to arrange 5-15% yourself.

- Explore scholarships: If you have scholarships/assistantships, many banks allow those to count toward margin money.

- Collateral & security: Even if margin is low, you may still need collateral/security depending on loan size and scheme.

- Read fine print: “Total cost” may include tuition, hostel, travel, books, living expenses—make sure you have the full estimate.

- Loan approval doesn’t mean full cost: The bank will sanction based on their eligibility, margin, security etc—not always 100% of your cost.

- Early planning: Margin money and co-applicant income/collateral arrangements take time. Start early.

Why Understanding Margin Money Matters

- Avoid surprises: You may assume the bank will cover everything; but if you didn’t budget margin money, you may be left short.

- Cashflow planning: You need to plan how you will pay the margin (savings, family, scholarship) before receiving the loan.

- Loan size matters: The larger your total cost and the more abroad/unfamiliar the institution, the higher the margin tends to be.

- Interest & repayment: Even though margin doesn’t directly affect interest rate, the smaller the loan amount, the less interest you’ll pay overall.

- Better negotiation: Knowing margin money allows you to compare loan schemes across banks and pick one with lower personal contribution.

Key Take-aways

- Margin money is the part you must contribute.

- For Bank of Baroda: 0% margin for certain domestic loans ≤ ~₹4 lakh; ~5% for certain domestic loans above ₹4 lakh; ~10-15% for study abroad or larger loans.

- Always check the exact scheme, amounts, institution classification.

- Use the formula to calculate margin money in your case.

- Budget for it, plan for it, don’t assume the bank will cover everything.

Final Thoughts

When planning your higher education financing through Bank of Baroda, understanding margin money helps you make a realistic budget and avoid last-minute surprises. Whether you are enrolling in an institution in India or going abroad, factor in your personal contribution, check whether your university is on the bank’s “Premier” list, review the collateral requirements, and ensure you are comfortable with how much you’ll need to bring.

By doing this, you can approach your education loan with greater confidence, clarity and control.